Aviation Daily News

U.S.-China Trade War Escalates: New Tariff Lists Released, Aviation Trade at Risk

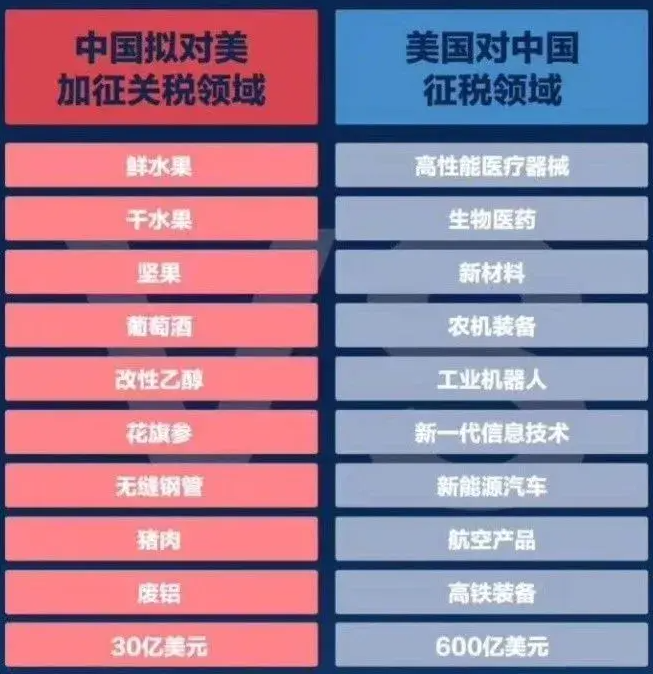

Beijing/Washington — China has announced plans to impose retaliatory tariffs on a range of U.S. imports, responding to Washington's earlier levies on Chinese goods. The Chinese list targets agricultural products, food, and industrial materials—including fruits, nuts, wine, seamless steel pipes, and pork—worth approximately $3 billion. Meanwhile, the U.S. had previously imposed tariffs on $60 billion worth of Chinese goods, focusing on high-tech sectors such as advanced medical devices, biopharmaceuticals, new materials, and aerospace products.

Key Figures: U.S.-China Trade Dispute

- $3 billion - Value of U.S. goods targeted by China's new tariffs

- $60 billion - Value of Chinese goods under U.S. tariffs

- 25% - Average tariff rate imposed by both nations

- 300+ - Aerospace products affected by the measures

Aviation Trade Faces Uncertainty

The inclusion of aerospace products in the U.S. tariff list could significantly impact bilateral aviation trade. China, one of the world's fastest-growing aviation markets, relies heavily on U.S.-made aircraft and aviation technology. Boeing, a key supplier to Chinese airlines, may see declining orders if tariffs drive up costs.

Analysts warn that higher tariffs could push Chinese carriers to seek alternatives, such as Airbus aircraft or China's domestically developed COMAC C919. Additionally, U.S. restrictions on aerospace exports might disrupt China's supply chain, potentially delaying projects that depend on American components.

Long-Term Implications

The aviation industry relies on global supply chains, and prolonged trade tensions could increase costs and slow innovation. While China may accelerate its self-sufficiency efforts in aerospace technology, experts caution that achieving independence from foreign suppliers will take years.

Both nations have yet to signal willingness to negotiate, raising concerns about further economic fallout. The international community urges dialogue to prevent broader disruptions to global trade.

"The aviation sector is particularly vulnerable to trade disputes because of its globalized nature. These tariffs could add significant costs to aircraft production and maintenance worldwide," said Dr. Li Wei, aviation economist at Beijing Aviation Institute.

Industry observers note that the trade tensions come at a sensitive time for Boeing, which has been working to rebuild its relationship with Chinese airlines following the 737 MAX grounding. China was the first country to ground the 737 MAX in 2019 and was among the last to recertify the aircraft.

The new tariffs could also affect ongoing negotiations between COMAC and potential Western suppliers for the C919 program, as well as maintenance contracts for existing fleets of U.S.-made aircraft in China.